Our Team

Deep expertise and an entrepreneurial

approach to multi-asset class investing

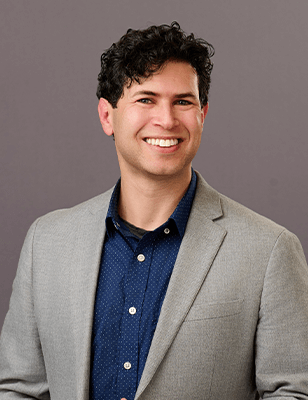

Tony CappellPartner

Tony CappellPartner

As a debt investor with over 15 years of experience in the specialty finance space, Tony has completed over 150 deals comprising over $5B in total credit. Prior to founding Chicago Atlantic, Tony was a Managing Director and Head of Underwriting at Stonegate Capital, a private credit investment firm focused on lower middle market businesses and emerging brands. At Stonegate, he was responsible for credit, underwriting and the growth strategy of the loan portfolio. Previously, he was a Senior Underwriter at First Midwest Bank and at Gibraltar Business Capital where he worked on a number of specialty finance transactions including technology, software, turnaround/distressed and re-discount loans. He began his career at Wells Fargo Capital Finance focused on a wide array of industries and loan structures.

MBA, The University of Chicago Booth School of Business

BA, University of Wisconsin, Milwaukee

John MazarakisPartner

John MazarakisPartner

John brings over 20 years of entrepreneurial, operational, and managerial experience to Chicago Atlantic. Over the last two decades, he has launched successful companies in real estate, retail, hospitality, and food logistics compounding an initial investment of $50,000 to over $75mm in value over a period of approximately 25 years. He has built, owned, and operated 35+ restaurants with more than 1,200 employees. In addition, John has built a real estate portfolio of over 30 properties, developed over 1 million square feet of commercial real estate, and completed multiple real estate financing transactions. John bought a small distribution company with $12mm in annual sales and grew it to over $90mm in less than two years. He has invested in and served as an advisor to multiple successful startups. John’s day to day involvement includes running operations and evaluating investments for Chicago Atlantic.

MBA, The University of Chicago Booth School of Business

BA (Economics), University of Delaware

Andreas BodmeierPartner

Andreas BodmeierPartner

Andreas has been working at the intersection of finance and analytics for over 15 years. Prior to founding Chicago Atlantic, Andreas co-founded a boutique technology and consulting firm focused on FX and commodity risk management for multi-national corporations as well as advising on capital structure decisions and investor relations. He was also a co-founder of an SEC-registered online investment adviser for 401(k) or 403(b) retirement accounts. As Chief Investment Officer and Chief Compliance Officer, Andreas built the firm’s investment methodology and compliance program. Andreas has also served as a consultant for hedge funds, proprietary trading firms, commercial and consumer lenders, and pharmaceutical companies. His academic research at The University of Chicago Booth School of Business focused on capital market anomalies, portfolio allocation, and risk management.

Ph.D. (Finance) and MBA, The University of Chicago Booth School of Business

MSc (Statistics), Humboldt University Berlin, Germany

BSc (Mathematics), Freie University Berlin, Germany

BSc (Physics), Freie University Berlin, Germany

BSc (Business Economics), University of Hagen, Germany

Peter SackManaging Partner & REIT Co-CEO

Peter SackManaging Partner & REIT Co-CEO

Peter is a Managing Partner at Chicago Atlantic and serves as Co-CEO of Chicago Atlantic Real Estate Finance, Inc., our affiliated mortgage REIT. Peter is a credit investor and portfolio manager with experience investing across the capital structure.

Prior to joining Chicago Atlantic, Peter was a Principal at BC Partners Credit, where he sourced and underwrote across the firm’s opportunistic and senior lending strategies in a wide array of industries. Peter managed the portfolio of BC Partners Lending Corporation, a private business development company with assets of over $100 million deployed in middle-market private loans. Peter also founded the firm’s cannabis vertical and has underwritten over half a billion dollars in related transactions.

Previously, Peter was an Associate at Atlas Holdings LLC, a private-equity firm focused on supporting distressed manufacturing and distribution companies globally.

Peter serves on the board of directors of Chicago Atlantic Real Estate Finance, Inc., Ability Insurance Company, and the New York City Charter School of the Arts.

Peter speaks Mandarin Chinese and Spanish.

MBA, the Wharton School of the University of Pennsylvania

BA, Yale University

Fulbright Scholar, Sun Yat-sen University, Guangdong Province, China

David KiteManaging Partner & COO

David KiteManaging Partner & COO

David is a Managing Partner at Chicago Atlantic and serves as Chief Operating Officer of Chicago Atlantic Real Estate Finance, Inc., our affiliated mortgage REIT.

David began his career as a commodities trader with Commodities Corp where legendary traders Paul Tudor Jones, Bruce Kovner and Louis Bacon launched their careers. Soon after, David founded K&K Capital Management, where he created a proprietary trading strategy which at its peak managed in excess of $250 million and generated average annual net returns of 19% for nearly a decade.

In 2013, David transitioned to real estate as Partner and COO of Free Market Ventures a boutique private equity real estate company where he developed over 200 multifamily units, built over 100k SF of cannabis cultivation warehouses, acquired and managed over 250k SF of office space, purchased in excess of $25 million in distressed debt and receiver liens and oversaw all aspects of the company including deal structure, capital raising, debt financing, due diligence, acquisitions, asset management and dispositions.

MBA, The University of Chicago Booth School of Business

BA (Economics), University of Illinois

David EnrightPartner, Head of Direct Lending

David EnrightPartner, Head of Direct Lending

As a debt investor with over 21 years of experience in the specialty finance space, David has completed over 300 deals comprising over $7.5 billion in total credit. Prior to joining Chicago Atlantic, David was an SVP responsible for the strategy of Specialty Finance and C&I lending at S&T Bank (NASDAQ: STBA). Previously, he was National Head of Sales at First Midwest Bank and co-founder of Specialty Finance for First Financial Business Capital, a division of First Financial Bank. While at both First Midwest and First Financial Business Capital, David worked on a number of specialty finance transactions including mezzanine loans, unitranche in almost every industry sector, asset-based lending, technology, software, turnaround, rediscount and many more. He began his career at National City Bank focused on a wide array of industries and loan structures.

BA (Economics), Kenyon College

Michael EizengaManaging Director & Head of Real Estate

Michael EizengaManaging Director & Head of Real Estate

Michael is Managing Director & Head of Real Estate at Chicago Atlantic. Michael brings over 15 years of real estate investment and development experience to Chicago Atlantic. As a Principal at The Jaffe Companies, one of the Midwest’s preeminent mixed-use development firms, Michael’s responsibilities have included acquisitions, development, financing, and leasing activities within the company’s portfolio. Most recently, Michael developed The Arboretum of South Barrington, a $100 million upscale lifestyle center that was sold to Starwood Capital Group, as well as the Edens Collection, a $60 million Target-anchored retail project in the City of Chicago.

Prior to joining The Jaffe Companies in 2007, Michael was Vice President at The Binswanger Company where he consulted with national corporate clients on their real estate holdings. In his early career, Michael worked in Paris, Milan, Brussels, and Frankfurt in Seimen’s global finance group.

Michael actively supports the Juvenile Diabetes Research Foundation, the Kovler Diabetes Center at The University of Chicago, and is a member of the International Council of Shopping Centers.

MBA, The University of Chicago Booth School of Business

BS, Indiana University Kelley School of Business

Andrew LovittGeneral Counsel & Chief Compliance Officer

Andrew LovittGeneral Counsel & Chief Compliance Officer

Andrew is General Counsel & Chief Compliance Officer at Chicago Atlantic. Prior to joining Chicago Atlantic, Andrew was an attorney in the Private Credit group at Katten Muchin Rosenman LLP, where he advised lenders and borrowers in numerous finance transactions, including cash flow and asset-based transactions, leveraged buyouts, refinancings, recapitalizations, and loan repayments.

JD, University of Pennsylvania Law School

BA, Purdue University

Sean ApfelbaumSr. Corporate Counsel

Sean ApfelbaumSr. Corporate Counsel

Sean is serving as Senior Corporate Counsel at Chicago Atlantic. Prior to joining Chicago Atlantic, Sean worked as an attorney in the Commercial Finance group at Goldberg Kohn Ltd. and two other international law firms where he represented bank and non-bank financial institutions, as well as borrowers in a broad range of financing transactions, including senior and second lien, asset based, and cash flow loan transactions.

JD, Northwestern University Pritzker School of Law

BA (Human Biology), Indiana University

Konstantinos NakisPartner & President, Chicago Atlantic Trident

Konstantinos NakisPartner & President, Chicago Atlantic Trident

Konstantinos (Gus) joined Chicago Atlantic as co-founder of Chicago Atlantic Trident strategy. He is Partner and President of Chicago Atlantic Trident, overseeing the strategic direction, operations, and growth of the strategy. He is also a member of the Investment Committee having extensive experience in finance, real estate and equity investing. Prior to this he was CFO of Chicago Atlantic Trident overseeing the financial strategy, policies, operations and procedures as well as the fundraising operations of the strategy. Prior joining Chicago Atlantic, Gus worked for nearly 6 years at the International Finance Corporation (IFC), member of the World Bank Group.

MSc (Finance), London School of Economics & Political Science (LSE)

MSc (Applied Mathematics), George Washington University

BSc (Mathematics and Economics), George Washington University

Dmitriy LampertPartner, Chicago Atlantic Trident

Dmitriy LampertPartner, Chicago Atlantic Trident

Dmitriy joins Chicago Atlantic Trident following a sixteen year legal career, most recently as Partner of international law firm Katten Muchin Rosenman LLP and before that at Jones Day, leading private equity and credit dealmaking, risk mitigation and restructuring. As a deal lawyer, Dmitriy has advised banks, direct lenders and other financial institutions in a broad array of financing transactions, including real estate as well as traditional and sponsor led M&A and LBOs. He is also accustomed to advising corporate trustees, third party administrative agents, servicers, issuing and paying agents and other providers in all stages of domestic and international structured transactions involving conventional debt, syndicated debt, asset-backed securities, CDOs, CLOs and municipal finance. Dmitriy is a first-generation Ukrainian-American immigrant. He manages the group’s legal and operational teams and is able to effectively translate and negotiate with international parties.

JD, Law, The George Washington University Law School

Certificate, International Arbitration, Queen Mary University of London

BA (Computer Science and International Relations), Lake Forest College

Sergiy TsivkachManaging Partner - Ukraine, Chicago Atlantic Trident

Sergiy TsivkachManaging Partner - Ukraine, Chicago Atlantic Trident

Sergiy Tsivkach serves as Managing Partner – Ukraine for the Chicago Atlantic Trident strategy, bringing more than 20 years of professional experience in corporate and government sectors across Ukraine, the US and the UK. Based in Kyiv, he ensures seamless communication and efficient deal flow with local companies and business partners, supporting smart, profitable and impactful investments. Prior to Chicago Atlantic, Sergiy served as CEO of UkraineInvest, the investments promotion office of the Government of Ukraine, and as a staff advisor to the Prime Minister of Ukraine. During his tenure at UkraineInvest, the agency facilitated the attraction of over $2 billion in Foreign Direct Investments (FDIs) into the Ukrainian economy, including 43 projects in infrastructure, real estate, logistics, energy, agriculture, construction materials, automotive and other sectors ranging in size up to $300 million. Sergiy’s career history also includes professional collaboration with the U.S. Federal Trade Commission (FTC) and the Organisation for Economic Co-operation and Development (OECD). Sergiy has been leveraged by CNN, Fortune, The New York Times, The Wall Street Journal and others for expert commentary on economic and investment matters concerning Ukraine. He also serves as an Adjunct Fellow at the Center for Strategic and International Studies (CSIS), a distinguished Washington D.C.-based think tank.

Diploma, King’s College, London

MA, University of Westminster, London

MA/BA, International Science and Technology University (ISTU), Kyiv

Hayden KellyPartner, Head of Investor Relations

Hayden KellyPartner, Head of Investor Relations

Hayden, a Partner at Chicago Atlantic and Head of Investor Relations, brings with him a wealth of experience in capital raising and investor relations. Prior to joining Chicago Atlantic, Hayden dedicated two years to the orthopedic field. During his pursuit of a bachelor’s degree, he contributed his expertise to Novo Nordisk. Following graduation, he assumed a pivotal role as one of five partners tasked with the growth and maintenance of a $14.5 million orthopedic sales territory for Stryker Orthopedics in Brooklyn, NY. Within Chicago Atlantic, Hayden has been instrumental in forging new client relationships and fortifying the firm’s existing client base. Presently, his responsibilities encompass managing investor relations, with a specific focus on Registered Investment Advisors (RIAs), family offices, and institutional clients for Chicago Atlantic’s private funds. Notably, Hayden is also pursuing further education at the University of Chicago.

BS, University of Delaware

Phil SilvermanChief Financial Officer, Chicago Atlantic Real Estate Finance, Inc.

Phil SilvermanChief Financial Officer, Chicago Atlantic Real Estate Finance, Inc.

Phil currently serves as the Chief Financial Officer of our publicly traded mortgage real estate investment trust (“REIT”), Chicago Atlantic Real Estate Finance, Inc. (NASDAQ: REFI). Phil is a licensed Certified Public Accountant and brings over 10 years of finance and accounting experience to Chicago Atlantic with a focus on financial reporting, operations, and internal controls for investment management firms ranging from $100 million to over a $1 billion in assets under management.

From June 2021 to September 2022, prior to his appointment as the Interim Chief Financial Officer of REFI, Phil served as the Vice President and Assistant Controller for the firm’s private credit funds, and Chief Financial Officer of Chicago Atlantic Group, LLC. Prior to joining Chicago Atlantic, Phil spent nearly 9 years with BDO USA, LLP, where he most recently served as a Senior Manager in the Financial Services and Private Equity group, responsible for end-to-end execution of audits of private equity and venture capital funds, small business investment companies, business development companies and other asset managers.

BS (Finance), Indiana University Kelley School of Business

Kristi KeeleyChief Financial Officer, Chicago Atlantic Advisers, LLC

Kristi KeeleyChief Financial Officer, Chicago Atlantic Advisers, LLC

Kristi serves as Chief Financial Officer at Chicago Atlantic and is responsible for financial accounting and reporting of Chicago Atlantic’s private investment vehicles.

Prior to joining Chicago Atlantic, she worked as a Manager at KPMG, gathering over 6 years of experience in accounting and taxation. During her tenure at KPMG, she focused on private credit and private equity fund clients, gaining exposure to many facets within the industry and region. Kristi holds the CPA designation and is a CFA charter holder.

BS (Accounting & Finance), DePaul University

Jack FlahertyManaging Director, Credit

Jack FlahertyManaging Director, Credit

Jack joins after 14 years at GAM in New York City as Investment Director and co-head of credit strategies firmwide and also was co-manager of GAM’s unconstrained/absolute return bond strategy responsible for credit positions ranging from investment grade to high yield debt including both asset-backed and mortgage-backed securities allocations. In addition, he has extensive experience in structured credit, trade finance, lending strategies and insurance linked securities. He was previously global co-head of credit fixed income and global head of emerging markets at UBS and worked as a managing director at Barclays Capital in charge of credit fixed income.

Jack Flaherty holds the Series 7, 63 and 24 qualifications. He is currently living in Los Angeles.

MBA (Finance and Accounting), University of Chicago

BA (Economics), University of Illinois

Tim AndersonManaging Director, Institutional Business Development

Tim AndersonManaging Director, Institutional Business Development

With twenty-three years’ experience in the alternatives space, Tim has successfully raised over $3 billion in capital for multi-strategy hedge funds, credit funds and a family office anchored real estate fund. He most recently served as Managing Director at Marquee Capital, a real estate firm within the Marcus Family Office, for which he raised $190 million. Tim’s career also includes tenures at Stark Investments, Trian Credit Partners, 3i Capital, Macquarie and One William Street Capital Management.

With relationships across the allocator universe, Tim has worked to raise capital with institutions, consultants, family offices, pensions and wealth managers alike. He presently leads Chicago Atlantic’s institutional fundraising efforts.

MBA (Finance, Investments & Banking), University of Wisconsin-Madison

BA, Vanderbilt University

Ryan MuranakaManaging Director, Digital Mining

Ryan MuranakaManaging Director, Digital Mining

Ryan is a Managing Director at Chicago Atlantic, leading the Digital Mining strategy. He played a key role in developing over 2 exahash of bitcoin mining data centers and has experience in negotiating power agreements with utilities. Additionally, he oversees the management of Chicago Atlantic’s fleet of bitcoin miners.

Ryan also has over 20 years of experience in commercial real estate bridge financing, having overseen more than $2 billion in directly originated secured real estate loans across various asset classes. Before joining Chicago Atlantic, Ryan worked in loan origination and asset management for family offices and public corporations, including Yam Capital and IMH Financial Corporation, where he was affiliated for 15 years.

BS (Business & Communications), Arizona State University

Martin RodgersSr. Managing Director, Finance & Accounting

Martin RodgersSr. Managing Director, Finance & Accounting

Martin brings over 30 years of accounting, finance, project and risk management experience to Chicago Atlantic. Prior to joining the firm, Martin spent 15 years at First Eagle Alternative Credit, a $20 billion Alternative Credit Manager specializing in Bank Syndicated Loans and Direct Lending Debt, in various roles ranging from Director of Finance and Administration, and Director of Alternative Credit Risk, with responsibilities for Fund Accounting, Performance Measurement, Enterprise Risk Management, and special projects.

Martin started his career in the United Kingdom and spent 4 years in the audit practice at PricewaterhouseCoopers. He has also held positions at Goldman Sachs, Abbot Laboratories, and Jefferson Wells.

BA (Accountancy and Economics), University of Stirling, Scotland, UK

CA, Institute of Chartered Accountants of Scotland

Thomas GeoffroyManaging Director, Finance & Accounting

Thomas GeoffroyManaging Director, Finance & Accounting

Thomas has 20 years of accounting and finance experience with expertise in financial reporting, operations and internal controls for the financial services industry including extensive investment fund experience. Before joining the firm, Thomas was Chief Financial Officer of a NASDAQ listed mortgage REIT, a publicly traded credit-focused asset management firm, and family office. Prior to that he was Finance and Operations Principal (CFO), General Securities Principal and Chief Compliance Officer for United Capital Markets, a registered broker-dealer specializing in structured finance products. Thomas worked as Controller at Ares Management, and before that he served as Vice President of Fund Administration and Financial Reporting at S.A.C. Capital Advisors. Thomas spent 9 years as a CPA with Ernst & Young where he was a Senior Manager in the Financial Services Organization’s hedge fund audit practice.

Thomas is a licensed Certified Public Accountant and member of the American Institute of Certified Public Accountants.

Matthew TaylorManaging Director

Matthew TaylorManaging Director

Matthew has nearly 20 years of executive leadership experience. He has lead companies in all life cycles, from venture-backed, to distressed asset turnarounds. His industry experience includes telecommunications, healthcare, finance, defense, and technology. He previously served as CEO-in-Residence of a Venture Studio and has raised and deployed capital in both Venture and Private Equity transactions. He is an active start-up investor and board member. He began his career as an Officer in the United States Marine Corps, where he served 10 years.

MBA, The University of Chicago Booth School of Business

MSc, (Finance) Southern Methodist University

BS, Indiana University

Alise EdgcombManaging Director, Public Relations

Alise EdgcombManaging Director, Public Relations

Alise brings 15+ years of public relations, marketing and journalistic experience to Chicago Atlantic, where she is responsible for the firm’s integrated communications strategies. Alise has successfully managed public relations programming across a diverse range of brands, from Fortune 500 companies to independent high-growth businesses across B2B and B2C sectors. She has ushered companies through all phases of growth, from VC fundraising to M&A to international expansion. Her portfolio includes secured editorial coverage in Fortune, Entrepreneur, Bloomberg, Financial Times, TODAY, Good Morning America, WSJ, The New York Times, Associated Press and countless others. Prior to Chicago Atlantic, Alise managed a consultancy dedicated to media relations and executive training for top firms, served as Vice President at 5W Public Relations and held roles with Cramer-Krasselt and Conde Nast.

BA (Public Relations and Marketing), Marquette University

Alan SchuchnerChief Analytics Officer

Alan SchuchnerChief Analytics Officer

Alan is a Chief Analytics Officer at Chicago Atlantic focusing on underwriting and portfolio management. Prior to joining Chicago Atlantic, Alan spent 5 years of his career in management consulting, having worked with multiple clients focusing on strategy and operations across various industries, including financial services, pharmaceuticals, telecommunications, and others. During his consulting career, Alan conducted multiple assessments of the business operating model of important national players and provided strategic recommendations to improve operational efficiency and reduce costs through digitalization, automation, and resource management. Alan has also worked as an underwriting analyst for Stonegate Capital, a Chicago-based ABL firm, performing financial analysis, implementing a portfolio management system, and making recommendations on loan pricing and terms.

MBA, The University of Chicago Booth School of Business

BSc (Industrial Engineering), ITBA, Buenos Aires, Argentina

Ali ZamaniSr. Director, Equity & Credit

Ali ZamaniSr. Director, Equity & Credit

Ali is a Senior Director at Chicago Atlantic focusing on equity and credit investments with emphasis on investment research, execution and portfolio management. He has over 13 years of investment and capital markets advisory experience. Ali is a CFA and a holder of the Advanced Financial Modeler (AFM) designation.

Prior to joining Chicago Atlantic Group, Ali spent ~4 years at a North American hedge fund covering public and private equity as well as structured product investments across various industries. Prior to that, Ali spent six years in investment banking at BMO Capital Markets and other investment banking institutions covering a multitude of sectors including Tech, Telecom, Media, Metals & Mining, and Diversified Industries. To date, he has been involved in over $10 billion of M&A, equity, and debt financing transactions.

Master of Financial Economics (Finance), University of Toronto Rotman School of Management & Economics

MA (Economics), York University

BA (Honours in Economics), York University

BS (Honours in Biology), York University

Elizabeth QuinlivanDirector, Underwriting & Portfolio Management

Elizabeth QuinlivanDirector, Underwriting & Portfolio Management

Liz is the Director of Underwriting & Portfolio Management at Chicago Atlantic and is responsible for deal structuring, underwriting, and portfolio management of private debt investments.

Prior to joining Chicago Atlantic, her credit experience spans underwriting and portfolio management in both bank and private debt settings. Liz was a cash flow lending underwriter in Fifth Third Bank’s Leveraged Finance group, a leveraged buyout cash flow lending underwriter and portfolio manager at Madison Capital Funding in their software and technology enabled services team, and she structured and underwrote M&A and growth capital financings for a private debt social impact fund. Prior to her credit career, Liz worked in consulting and strategic advisory for nearly 5 years at Ocean Tomo in their valuation practice.

MBA (Finance & Business Strategy), DePaul University

BA (Economics), University of Illinois at Urbana-Champaign

Steven ErnestVice President, Originations

Steven ErnestVice President, Originations

A longtime advocate and investor in cannabis, Steve has worked in the cannabis space since 2015. He first began his journey as an angel investor and then, in 2016, became a serial entrepreneur as a key founding member for two cannabis investment bank advisories, Mazakali and Sharp Capital. Before moving into cannabis, Steve worked as a wealth management advisor at J.P. Morgan, managing a book worth more than half a billion dollars for his clients. Regardless of industry, Steve has spent the entirety of his career focused on building community. He is passionate about building relationships, advising brands, and consulting with companies looking to navigate the capital markets. He views himself as and strives to be a connector of dots in the cannabis landscape. In his spare time, he sits on the finance committee for Students for Sensible Drug Policy, the largest global youth-led network dedicated to ending the War on Drugs. An avid researcher and writer, Steve has appeared on multiple cannabis podcasts and written editorials and informative articles for industry leading publications like MJBiz.

BS (Risk Management and Finance), Illinois State University

Jordan LiptonVice President, Originations

Jordan LiptonVice President, Originations

Jordan is a Vice President at Chicago Atlantic focusing on originations. Jordan brings over 12 years of capital markets, investment banking, private equity, and private debt experience across various markets.

Prior to joining Chicago Atlantic, Jordan held a managing director position at a Canadian Merchant Bank, overseeing the firm’s strategies and investments in cannabis, fintech, and AI. Previously, Jordan served as a partner at Silverbear Capital, a boutique investment bank in Hong Kong. He was also a director of originations and credit at AM Capital Receivables Management, a trade finance and asset-based lender in Hong Kong and China.

Jordan has been active in the cannabis industry since 2014 working as an investor, executive and advisor. Jordan previously held a senior management position with a privately held vertically integrated operator spanning eight states. Jordan has completed over $250 million in cannabis related equity and debt financing transactions.

MBA International Business, European Business School

MBA Exchange Program, Korea University Business School

LLB, University of London

BA, Huron University

Matt BradyVice President, Real Estate Credit

Matt BradyVice President, Real Estate Credit

Matt Brady is a Vice President of Real Estate Credit at Chicago Atlantic and brings 20 years of commercial real estate lending experience to the team. He is responsible for analyzing commercial real estate lending opportunities, assessing risk, building financial models and evaluating borrower and guarantor financial strength.

Prior to joining Chicago Atlantic, Matt was responsible for underwriting loans for YAM Capital, one of the largest national family office bridge lenders focused on bridge loans for commercial real estate. Previously he was with IMH Financial Corporation, a public reporting commercial real estate bridge lender, for 16 years where he played an integral role in the firm’s funding and management of over $1 billion in debt and equity investments.

MBA, Arizona State University

BS, Arizona State University

BJ Garing, RAVice President, Real Estate

BJ Garing, RAVice President, Real Estate

BJ is Vice President of Real Estate at Chicago Atlantic and brings over 18 years of Architecture and Construction experience to Chicago Atlantic.

Prior to joining the firm, BJ was a Project Director at UPMC Corporate Construction and Real Estate, one of Western PA’s prominent Hospital systems. Responsibilities included project management, design, equipment planning, contracts & construction oversight. BJ was also part of the team overseeing the New UPMC Presbyterian Bed Tower, a 17+ story 1.2 million sf addition and renovation to serve 636 all new state of the art patient rooms and 12 additional OR’s.

Before UPMC Corporate Construction and Real Estate in 2008, he was with Perkins Eastman as an Associate involved with the firm’s work in senior living and worked on projects across the full continuum: supportive housing, CCRCs, assisted living, long-term care and chronic care hospitals. His oversight provided continuity in design quality, documentation, technical execution, and process.

BJ actively supports youth hockey as a volunteer coach and is a licensed architect in the State of Pennsylvania.

ARCH, Kent State University

BS, Kent State University

Kyle BarthelVice President, Growth and Technology Finance

Kyle BarthelVice President, Growth and Technology Finance

Kyle serves as Vice President of Technology and Growth Finance at Chicago Atlantic. He focuses on sourcing and executing growth capital and technology finance opportunities within the group’s direct lending strategy.

Kyle has a combined eight years of experience providing venture debt and growth capital to technology, tech-enabled service and consumer companies across all stages of the life cycle. Prior to joining Chicago Atlantic, Kyle was a Vice President with the Technology and Venture Banking Group at Customers Bank. While there, Kyle deployed over $130 million in SaaS, leveraged bank financing to growth- and late-stage companies and oversaw a portfolio of over $270 million in total commitments.

Other previous roles include Business Development Associate at Runway Growth Capital, where he focused on late-stage venture debt opportunities for both sponsored and non-sponsored technology companies, and Analyst and Client Manager at PacWest (formerly known as Square 1 Bank), where he focused on early-stage life sciences and technology venture debt. Kyle also spent a year working for a Series B startup, leading that company’s sales into venture capital and private equity firms.

MS (Finance), Tulane University

BA (History), University of Wisconsin-Madison

Michael TrompeterVice President, Growth and Technology Finance

Michael TrompeterVice President, Growth and Technology Finance

Michael Trompeter is a Vice President of Growth and Technology Finance at Chicago Atlantic. He is responsible for the origination and execution of investments on the Direct Lending team. Prior to joining Chicago Atlantic, he was a Senior Associate at Golub Growth, where he invested across the capital structure and was responsible for originating, screening and diligence of late-stage enterprise software investments. During this time, Golub Growth deployed over $1 billion into late-stage enterprise software companies. Prior to his work with Golub, Michael worked at Waud Capital Partners on the business development team, sourcing platform and add-on opportunities for the multi-billion dollar private equity firm.

BS (Finance), Illinois State University

Alex RigosVice President, Underwriting

Alex RigosVice President, Underwriting

Alex is a Vice President at Chicago Atlantic focusing on underwriting and portfolio management of private debt investments in cannabis and non-cannabis companies. Prior to joining Chicago Atlantic, Alex spent 4 years in private credit, most recently at LBC Credit Partners, focusing on underwriting direct lending investments to private equity sponsor-backed companies in a variety of industries. Alex spent the first 5 years of his career at Bank of America Merrill Lynch in underwriting, portfolio management, and origination roles across the commercial banking and specialty lending platforms. In his last few years at Bank of America, he performed as the senior underwriter in a specialty lending group focused on complex recurring-revenue debt structures.

BS, University of Dayton

Nathan BergerVice President, Underwriting

Nathan BergerVice President, Underwriting

Nathan is a Vice President at Chicago Atlantic, focusing on underwriting and portfolio management of private debt investments. Nathan has 5 years of experience spanning roles in underwriting, corporate finance and investor relations, and investment banking. Nathan was most recently an Investment Associate with AFC Gamma (NASDAQ: AFCG), an institutional capital provider to the cannabis and commercial real estate industries. Prior to this experience, Nathan worked on the Corporate team at Ventas, Inc. (NYSE: VTR), a leading healthcare REIT, supporting the company’s corporate financial planning and investor relations functions. Nathan began his career at Livingstone Partners as an Analyst supporting M&A and debt advisory mandates in the Industrials and Business Services sectors. He completed internships with Capstone Partners, a middle-market investment bank, and Morgan Stanley in private wealth management.

MBA (Finance & Healthcare Management), Johns Hopkins University

BS (Finance), University of Illinois Urbana-Champaign

Edward StumDirector, Borrower Operations

Edward StumDirector, Borrower Operations

Ed is the Director of Borrow Operations at Chicago Atlantic and brings over 30 years of operational and managerial experience. Prior to joining Chicago Atlantic, Ed was the Chief Operating Officer of Parea Biosciences and Keystone Centers for Integrative Wellness, a Pennsylvania medical marijuana vertical. Before working in the cannabis sector, Ed was the Executive Vice President of Manufacturing Operations where he achieved success in pharmaceutical facility, medical device, and military systems design and manufacture, leading to award-winning systems for Pfizer, ITH Pharma, TOMI Environmental Solutions, BAE Systems, and Newport News Shipbuilding. Additionally, Ed is certified as a six-sigma blackbelt, lean practitioner, and quality professional, with proficiency in seed-to-sale and quality management systems in the cannabis space.

MBA, The Pennsylvania State University Smeal College of Business

BS (Mechanical Engineering), The Pennsylvania State University

Max BurgeDirector, Investor Relations

Max BurgeDirector, Investor Relations

Max Burge is a Director of Investor Relations at Chicago Atlantic, where he brings a wealth of experience in the financial services industry to his role. Max holds the Series 7 and Series 63 licenses and is a Certified Plan Fiduciary Advisor.

Before joining Chicago Atlantic, Max served as a Director of Investor & Consultant Relations at CBIS, a $10 billion AUM institutional investment manager. Prior to that, he served as a Regional Consultant at Morningstar and Morningstar Investment Services. He began his career in sales at Machinio, a Chicago-based start-up that had a successful exit in 2018.

BA (Economics and Spanish), Denison University

Carl IannacciDirector, Investor Relations

Carl IannacciDirector, Investor Relations

Carl is a Director of Investor Relations at Chicago Atlantic and brings with him a wealth of experience raising capital in the world of private placements and alternative investments. Prior to joining Chicago Atlantic, Carl began his career on the broker/dealer sales team at Eaton Vance. Since then, he has helped early stage investment managers raise capital in the Registered Investment Advisor (RIA), Family Office and Institutional space. Carl has also run his own private debt brokerage business for the past 3 years. Presently, his responsibility is to manage the Registered Investment Advisor (RIA) family office and institutional clients for Chicago Atlantic.

Hector GonzalezSr. Vice President, Investor Relations

Hector GonzalezSr. Vice President, Investor Relations

Hector is a Senior Vice President of Investor Relations at Chicago Atlantic. He brings over 5 years of experience in private banking, investments and client servicing.

Prior to joining Chicago Atlantic, Hector was a Second Vice President and an Associate Portfolio Advisor at Northern Trust. He worked on a Wealth Advisory team responsible for over $4 Billion in Assets Under Management. He collaborated with Investment Advisors to understand the overall investment strategy and may provide input for revisions as goals and objectives change and in the context of client needs working closely and proactively with the broader client service team to identify and execute on areas of opportunity.

Hector currently resides in Miami, FL. He enjoys playing tennis, golf, padel and watersports such as wakeboarding. During the winter, he is an avid snowboarder/skier.

BS (Finance), Bentley University

Brian FordonVice President, Investor Relations

Brian FordonVice President, Investor Relations

Brian is a Vice President of Investor Relations at Chicago Atlantic with nearly a decade of experience in the financial services industry. Brian holds his Series 7, 63, and 65 licenses and is currently pursuing his MBA from the University of Chicago Booth School of Business.

Before joining Chicago Atlantic, Brian served as Vice President of the Portfolio Solutions Group at Keebeck Wealth Management. Prior to that, Brian served as Senior Credit Portfolio Manager in the Global Family Office Group at Northern Trust, focused on underwriting and due diligence to structure strategic credit solutions for the firm’s most complex clients.

BA, Dartmouth College

Filippos DounisManager, Investor Relations

Filippos DounisManager, Investor Relations

Filippos Dounis is a Manager on the Investor Relations team at Chicago Atlantic with investment and consultancy expertise in global markets, emerging technologies, and private intelligence. His investment strategies and decisions are informed by a deep understanding of geopolitics and market trends, rooted in his education in Information Systems and Data Science from Carnegie Mellon University. This background supports his approach to international investment and his analytical methods in business.

Filippos uses data analysis to guide investments and operational strategies across various sectors, always with an awareness of the interplay between geopolitics and market dynamics. His career includes mediating significant petroleum deals in the Middle East, advising Middle Eastern royal families, and driving capital for hospitality ventures in Greece, demonstrating his ability to navigate complex market conditions.

His professional network is notably strong in Europe and the MEA region, aiding his ability to identify and seize market opportunities. Filippos has also shown a knack for turning complex data into actionable business intelligence, which he has applied in roles ranging from leading research and development in private intelligence to directing information security and threat intelligence strategies.

He has founded several ventures, including Elysium Designs London, SkyRam, and A&F Global Partners, showcasing his entrepreneurial spirit, while being an advisor to multiple fintech projects. His approach to business is informed by the potential of information to drive negotiation and investment decisions.

Overall, Filippos is an accomplished consultant and strategist with a data-driven approach to business, recognized for his ability to manage sophisticated ventures and contribute to sustainable growth in a dynamic economic landscape.

Kaan YucelAssociate, Investor Relations

Kaan YucelAssociate, Investor Relations

Genia KimDirector, Investor Services

Genia KimDirector, Investor Services

Genia is a Director of Investor Services at Chicago Atlantic where she is responsible for overseeing marketing, client services, and sales support for the firm’s private fund offerings.

Prior to joining Chicago Atlantic, Genia worked in the Client Group at GCM Grosvenor responsible for leading investor operations and marketing efforts spanning across the alternative investment platform. Prior to that, she helped to establish and manage sales operations to support a growing business development team within the Investor Partners Group at Golub Capital. Additionally, Genia has held positions at other alternative asset management firms to support and strengthen relationships with institutional investors.

MBA, University of Oxford

BS, University of Illinois Chicago

Lucie KimVice President, Client Services

Lucie KimVice President, Client Services

Lucie Kim is a Vice President of Client Services at Chicago Atlantic where she is responsible for servicing our existing client base.

Prior to joining Chicago Atlantic, Lucie was a Senior Vice President of Operations overseeing operations and technology for multiple real estate entities for a Chicago-based consulting firm. Prior to that, she was a Director in the Institutional Services Group for a Chicago-based real estate investment firm where she was responsible for establishing relationships and managing portfolios for multiple institutional investors. With over 20 years of experience, Lucie has held positions at other firms with a focus on portfolio management and building and managing relationships with institutional investors.

Kevin VargasVice President, Client Services

Kevin VargasVice President, Client Services

Kevin Vargas is a Vice President of Client Services at Chicago Atlantic, bringing over eight years of extensive experience in investor relations and accounting. Previously, Kevin held a key role at Brauvin Real Estate, a renowned Chicago-based commercial real estate investment firm, where he successfully managed investor relations and day-to-day operations. He provided investors with detailed information on their investments from inception and ensured accurate distributions, including the sale of a notable $200 million real estate fund. Kevin launched his career at KPMG, one of the world’s largest accounting firms, as an audit associate in their Real Estate and Investment Management Division. Outside of his professional pursuits, Kevin maintains an active lifestyle, engaging in weightlifting, football, and exploring the vibrant city of Chicago with friends and family.

BS (Accountancy), DePaul University

Amir RonController, Management Company

Amir RonController, Management Company

Amir is currently a Controller at Chicago Atlantic management companies. He previously served as the Accounting Manager responsible for month-end closing, intercompany reconciliations, cash forecasting, and tax compliance. Prior to Chicago Atlantic, Amir was an Accounting Analyst at Tekcapital, LLC, working alongside the CFO of a publicly traded company listed on the London Stock Exchange Marketing (AIM). Amir served as a Senior Staff Accountant at Pinchasik, Yellen, Muskat, Stein, LLC a South Florida accounting firm working on various assurance engagements for non-profits and for-profit companies, tax returns preparation, and eminent domain litigation cases. Amir also worked as a Forensic Analyst in the areas of business disputes and matrimonial litigation.

BS (Finance & Accounting), University of Maryland – Robert H. Smith School of Business, College Park

Christopher LeeController, Private Funds

Christopher LeeController, Private Funds

Chris has a strong background in financial accounting and reporting of private investment vehicles. He has extensive experience in fund administration, including venture capital funds and private equity funds. With his role as Controller at Chicago Atlantic and previous positions at Aduro Advisors, Alter Domus, and RSM, Chris has developed a deep understanding of managing and overseeing financial operations in the investment industry.

In addition to his expertise in finance, Chris also possesses knowledge and skills in process automation using Python and VBA. This proficiency allows him to streamline workflows and enhance efficiency in financial operations. Whether it’s leveraging Python for data analysis or utilizing VBA to automate repetitive tasks, Chris utilizes his technical capabilities to drive process improvement and optimize financial processes. Chris holds the CPA designation.

MS (Data Science), Northwestern University

BS (Accounting), University of Illinois at Chicago

Brett ClaytonController, Chicago Atlantic Real Estate Finance, Inc.

Brett ClaytonController, Chicago Atlantic Real Estate Finance, Inc.

Brett serves as the Controller of our publicly traded mortgage real estate investment trust (“REIT”), Chicago Atlantic Real Estate Finance, Inc. (NASDAQ: REFI).

Brett brings over 7 years of credit-focused asset management experience to Chicago Atlantic. Before joining Chicago Atlantic, Brett worked as Manager at H.I.G. Capital where she focused on reporting for private credit investment vehicles. Prior to that she was a Controller at a publicly traded business development company (“BDC”) within the credit platform at BC Partners. Brett spent the first 6 years of her career at Citigroup, within SEC Reporting and at Grant Thornton, within the Financial Services Audit practice. Brett holds the CPA designation.

BS and MS (Accounting), University of Texas at Austin

Lev SlavinVice President, Analytics

Lev SlavinVice President, Analytics

Lev is a Vice President at Chicago Atlantic focusing on analytics. Prior to joining Chicago Atlantic, Lev spent 12 years of his career providing hands-on expertise in corporate finance, strategy, and analytics as a consultant to entrepreneurial companies in a broad range of industries ranging from fintech to healthcare to education. During his consulting career, Lev focused on building the tools and processes that facilitate fact-based decision making, strategic planning and financial management necessary to a company’s successful development. For 10 of those years, Lev also worked in curriculum innovation and academic support at the University of Chicago Booth School of Business, where he was instrumental in developing and teaching a simulation-based capstone MBA course in which teams integrate knowledge from several business disciplines to grow a struggling startup into a successful competitor in a rapidly evolving industry. Lev spent the first 8 years of his career on an internal consulting team at CSX Transportation and in risk management at Citigroup.

MBA, The University of Chicago Booth School of Business

BS (Finance), University of Florida

Dennis HsuVice President, Loan Servicing

Dennis HsuVice President, Loan Servicing

Dennis Hsu is a Vice President, Loan Servicing at Chicago Atlantic overseeing the loan administration team and other operations functions. Prior to joining Chicago Atlantic, Dennis spent 7 years at Morningstar Investment Management as a trader and portfolio administrator focusing on technology implementation and scaling operations of the trading team. In addition, Dennis was the principal trader and administrator on portfolios worth a total AUM of $7 billion.

MBA, The University of Chicago Booth School of Business

BA (Economics), Northwestern University

Aneeqa AzharSr. Associate, Operations

Aneeqa AzharSr. Associate, Operations

Aneeqa Azhar serves as Senior Operations Associate assisting Chicago Atlantic’s Operations and Accounting Departments and brings over five years of Financial Services experience to Chicago Atlantic. Prior to joining Chicago Atlantic, she worked as an Operations Analyst at Optiver on the Back Office and Engineering Team and as an Analyst at Performance Trust Capital Partners and at Northern Trust Corporation.

BS (Finance), University of Illinois at Chicago

Christian KennedySr. Associate, Operations

Christian KennedySr. Associate, Operations

Christian is a Senior Operations Associate at Chicago Atlantic and brings 4 years of finance and operations experience in the alternative loan market and broadly syndicated loan market. Prior to joining Chicago Atlantic, he spent 3 years at First Eagle Investments within their alternative credit business, where he was a Senior Operations Analyst for their Asset Operations team. Christian started his career in financial services and Cortland Capital Markets (now Alter Domus), a middle market solution provider for alternative investment managers.

BS (Economics), University of Illinois Urbana-Champaign

Guadalupe ArreolaAssociate, Operations

Jenny ChanDirector, Head of Marketing

Jenny ChanDirector, Head of Marketing

Jenny is the Director and Head of Marketing at Chicago Atlantic with over 20 years of experience in investments and asset management. Prior to joining the firm, Jenny worked for a crypto fintech company serving as the Sales/Marketing Director and Director of Investor Relations. Before entering the crypto world, Jenny worked with CI Investments as a Marketing Director, leading efforts for their Assante Wealth Management and CI Private Wealth businesses supporting financial advisors, HNW, family offices, and RIAs. Jenny also has deep product marketing experience serving as the Manager of the Global Product Marketing team at Franklin Templeton Investments covering Fixed Income, Equity, Managed Solutions, Real Estate, and Alternatives for mutual funds, ETFs, SMAs and private funds for institutional and retail clients. Jenny held progressively senior positions at the institutional investment consultant firm, Cambridge Associates, supporting the research, capital markets, consulting, and firmwide operations functions, culminating with her role as Associate Director overseeing strategic projects. Jenny began her career in investment banking at J.P. Morgan as a Financial Analyst in their NYC office.

MBA, Georgetown University

BS (Economics), Vassar College

Olga CukrowskaAssociate Vice President, Marketing

Olga CukrowskaAssociate Vice President, Marketing

Olga is an Associate Vice President of Marketing at Chicago Atlantic. She brings with her over 15 years of various marketing, digital, social and communications experience, together with a decade of actuarial experience in pensions and investments. Her roles have spanned actuarial consulting, institutional sales support, end-investor copywriting and everything in between. Her actuarial science background gives her a solid foundation to understand and explain the technical aspects of financial solutions, while her design aesthetic and conversational writing style allows her to engage and inform the target audience in a clear and accessible way.

BSc (Actuarial Science), University of the Witwatersrand, South Africa

Robert CooperVice President, Analytics

Robert CooperVice President, Analytics

Robert is a Vice President of Analytics at Chicago Atlantic. Prior to joining Chicago Atlantic, Robert spent 11 years of his career in management consulting. As a consultant, Robert worked with numerous companies across a wide array of industries. Robert helped clients advance their analytical capabilities by building business intelligence dashboards, developing machine learning models, and everything in between. On all his engagements, Robert brought an eye for how his clients could better leverage their data to achieve their strategic objectives. Through this approach, Robert was able to lead his clients to significant successes, such as helping a telecommunications company migrate to a cloud data platform to reduce its data footprint by $5M and helping an engineering firm harness predictive analytics to improve its bidding profitability by 30%.

MBA, The University of Chicago Booth School of Business

BA (Economics), University of Chicago

Benjamin KarenasAssociate, Analytics

Benjamin KarenasAssociate, Analytics

Ben is an Associate on the Analytics team at Chicago Atlantic. Prior to joining Chicago Atlantic, Ben spent 2.5 years as a management consultant at Kenway Consulting solving difficult data-related problems for clients. Ben’s areas of focus are business intelligence, advanced analytics, data engineering, data management, and data governance. Ben has experience working with companies across numerous industries including financial services, tech, industrials, healthcare, and supply chain. Before becoming a consultant, Ben began his career at Citadel doing financial planning and analysis.

BBA (Finance & Information Systems), Loyola University Chicago

Sam EvartsAssociate, Analytics

Sam EvartsAssociate, Analytics

Sam is an Analytics Associate at Chicago Atlantic focused on working hands-on with portfolio companies to create operational efficiency and financial health through data-driven analyses. Prior to joining Chicago Atlantic, Sam spent 3 years in management consulting where he worked with multiple clients on data strategy and advanced analytics to identify opportunities to save costs and optimize internal resources. In addition to his advanced analytics projects, Sam also worked in organizational design and business transformation. Prior to consulting, Sam worked in investment research, tracking investment trends amongst top venture capital and corporate venture capital players and summarizing trends into consumable research reports.

Outside of work, Sam has been a musician for over 10 years and enjoys going to live music shows as well as watching hockey games, motorsport racing, and spending time with family.

BA (Data Analytics, Econometrics), Denison University

Suresh NilavarIT Manager

Suresh NilavarIT Manager

Suresh serves as the Information Technology Manager for Chicago Atlantic. Suresh brings over 17 years of IT experience. He started his career with tech MSPs in NYC for small and mid-size business clientele, then migrated to managing IT for hedge funds. In his previous management role, he architected the IT infrastructure for a mid-sized hedge fund across 3 offices in the US, Europe, and Asia. In his spare time, Suresh enjoys staying active, playing piano, and keeping up to date with technology.

BSBA (Information Systems), Xavier University

Jennifer CarterManager, Accounting

Jennifer CarterManager, Accounting

Jennifer is an Accounting Manager at Chicago Atlantic focusing on financial reporting for our funds and their investors. Jennifer brings 4 years of accounting and tax experience to Chicago Atlantic. Before joining Chicago Atlantic, Jennifer was a senior fund accountant at Blue Vista Capital Management, a Chicago-based real estate private equity firm. Prior to that, Jennifer spent 3 years at Plante Moran providing tax compliance services.

BS (Accounting), Illinois Wesleyan University

Daniel VincerSr. Fund Accountant

Daniel VincerSr. Fund Accountant

Daniel is a Senior Fund Accountant at Chicago Atlantic. Daniel brings 6 years of accounting and financial analysis experience to Chicago Atlantic. Prior to joining Chicago Atlantic, Daniel was a Senior Accountant with Cardone Capital working on all aspects of Real Estate funds and as an analyst at GEO Group within their Financial Planning & Analysis team.

Master of Accounting (MAcc), Nova Southeastern University

Dariana AltamarAccountant

Dariana AltamarAccountant

Dariana is an Accountant at Chicago Atlantic. Previously, Dariana served on the accounting team for New Look Vision Group where she focused on collecting, tracking and reconciling the company’s finances. Prior to that role, Dariana worked at Quintero & Partners, a financial advisory firm, where she was responsible for overseeing agents to ensure they provided the proper long-term strategies for building wealth and managing risk.

BA (Finance and Economics), Florida International University

John HatchSr. Associate, Analytics

John HatchSr. Associate, Analytics

John is a Senior Analytics Associate at Chicago Atlantic. Prior to joining Chicago Atlantic John spent 10 years as a consultant working with his clients to create and implement enterprise data strategies, aggregate and synthesize data from diverse business units, define custom metrics for specific business needs, and produce BI dashboards that provide actionable insights. As a consultant John regularly worked with multiple teams at his clients including finance, operations, sales, and marketing on business improvements including forecasting, anomaly detection, cost reduction, and strategy optimization. John has experience working with clients in the United States and internationally in numerous industries including legal, technology, manufacturing, retail, and financial services.

MSc (Finance), Hult International Business School, London

BS (Economics), College of Charleston

George KarakadasAssociate, Chicago Atlantic Trident

George KarakadasAssociate, Chicago Atlantic Trident

George is a dynamic entrepreneur with a passion for building innovative solutions, and a keen eye for cutting-edge opportunities in business and technology.

As an Analyst for Chicago Atlantic Trident, George helps shape Chicago Atlantic’s impact investing strategy and global private market investments. He was previously Founder & CEO of Dromos, where he led a visionary team in developing full-windshield augmented reality heads-up displays for vehicles. Before founding his startup, George was an Analyst at private investment firm AESION, where he closed the sale of a Homewood Suites by Hilton hotel at a 24.3% IRR. He has also served as Summer Analyst for Mavis Tire, the nation’s largest automotive aftermarket distributor, and Wentworth Management Services, an SPV set up to acquire and roll-up broker-dealers, where he prepared materials for a billion-dollar preferred equity raise. Before Wentworth, George was an Operations Intern at Capital Ship Management, one of the most prominent crude and refined petroleum tanker shipping companies in the world.

BS (Finance and Management), Kelley School of Business at Indiana University

Luis CardenasAssociate, Credit

Luis CardenasAssociate, Credit

Luis is an Associate at Chicago Atlantic focusing on supporting all aspects of the investment process including underwriting, originating, and portfolio management. Prior to joining Chicago Atlantic, Luis worked as an Investment Banking Analyst in the Mergers & Acquisitions group at BMO Capital Markets.

BS (Finance), University of Illinois at Urbana-Champaign

Jay CremerAssociate, Real Estate

Niko Mamatas Analyst, Underwriting

Niko Mamatas Analyst, Underwriting

Niko Mamatas is an Analyst focusing on underwriting and portfolio management. Prior to joining the team, Niko completed an internship with Chicago Atlantic, where he worked with the Underwriting team. Niko currently resides in Chicago, IL.

BA (Finance), Michigan State University – Eli Broad College of Business

Lila HuddlesAnalyst, Institutional Business Development

Lila HuddlesAnalyst, Institutional Business Development

Lila is an Analyst on the Institutional Business Development team at Chicago Atlantic. Prior to joining the team, Lila completed an internship with Chicago Atlantic, where she worked with the Underwriting team. Lila recently graduated from Vanderbilt University in Nashville, TN, and was a four-year member of the Women’s Division I Lacrosse team.

BS (Human and Organizational Development/Business), Vanderbilt University

Ramona StefanSr. Director, People & Culture

Ramona StefanSr. Director, People & Culture

Ramona is the Sr. Director of People and Culture at Chicago Atlantic, where she leads the people strategy and culture-building initiatives for the firm. With 15 years of experience, she specializes in developing data-driven HR practices that focus on engaging, developing, and retaining top talent in both private and public fintech companies.

Before joining Chicago Atlantic, Ramona was the Chief People Officer at Braviant, a fintech startup in Chicago. During her six-year tenure there, Ramona set and led the company’s people strategy, creating a cohesive, engaged, and high-performing workforce that significantly contributed to the company’s overall success.

MS (Human Resources), DePaul University

BS (Business Management), DePaul University

Briget BrewManager, HR & Operations

Briget BrewManager, HR & Operations

Briget serves as HR & Operations Manager at Chicago Atlantic Group in the Chicago office.

Prior to joining Chicago Atlantic, she worked as a Facilities & Office Manager at Monroe Capital for over 10 years, focusing on the day-to-day operations of several offices throughout the US.

Christina GavinGeneralist, Human Resources

Hilary AbtsExecutive Assistant

Hilary AbtsExecutive Assistant

Hilary is an Executive Assistant to the Founding Partners at Chicago Atlantic. Hilary joins Chicago Atlantic from ZS Associates spending the last 2 years as a Meetings & Travel assistant. Prior to ZS, Hilary spent 5 years based in Dubai as a flight attendant for Emirates.

BA, DePaul University

Jia PengSr. Advisor, Digital Mining

Jia PengSr. Advisor, Digital Mining

Jia recently joined Chicago Atlantic Digital Mining as a Senior Advisor. She has over 18 years of experience in investment banking, global capital markets, asset allocation, and private investing. She is a founding partner of Flying Tiger Capital, a family office investment platform. Prior to Flying Tiger Capital, Jia was a senior banker at the Leveraged Finance and Global Capital Markets department of UBS Investment Bank in New York. She is an energy and power sector specialist and well-versed in the U.S. electric power market. Over her decade-long investment banking career, she has provided M&A, IPO financing, and various types of capital strategy advisory services for Fortune 100 corporations and large private equity firms. Jia also worked at Citigroup and GE Capital earlier in her career and was a co-founder of a New York-based Macro hedge fund. With a wealth of global capital market experiences under her belt, she turned her attention to venture investing in recent years with a focus on AI, Fintech, and Web3. Her investment portfolio includes category leaders in AI/AR space, such as tomorrow.io and XR Health. Jia currently serves on the Board of the American Association of Individual Investors (AAII), a prestigious Chicago-based non-profit organization with over 2 million cumulative members worldwide.

Jia lives in Chicago with her family. She is a mother of two young children, an avid skier, and a certified alpine ski instructor.

Jasmine Yu ZhangSr. Advisor, Digital Mining

Jasmine Yu ZhangSr. Advisor, Digital Mining

Jasmine brings over a decade of experience in entrepreneurship, technology, and investments to Chicago Atlantic Digital Mining. She is a founding partner of Flying Tiger Capital, a family office and venture capital firm, and a 2021 LinkedIn China Top Voice and Venture Partner at VU Venture Partners. Before her investment career, she co-founded two startups, and worked at Nordson Corp, Nokia, and HERE Technologies. With experience in Asia and throughout Europe, Jasmine graduated in Strategic Decision and Risk Management at Stanford University and holds a Master of International and Development Economics from the Australian National University. She is passionate about promoting gender equality and financial education for adults and children alike. A world traveler, Jasmine has visited over 45 countries and currently lives outside of Chicago with her husband and two young children.