January 12, 2024

Why Specialty, Niche Private Credit? An Expert Outlook for Modern Investors

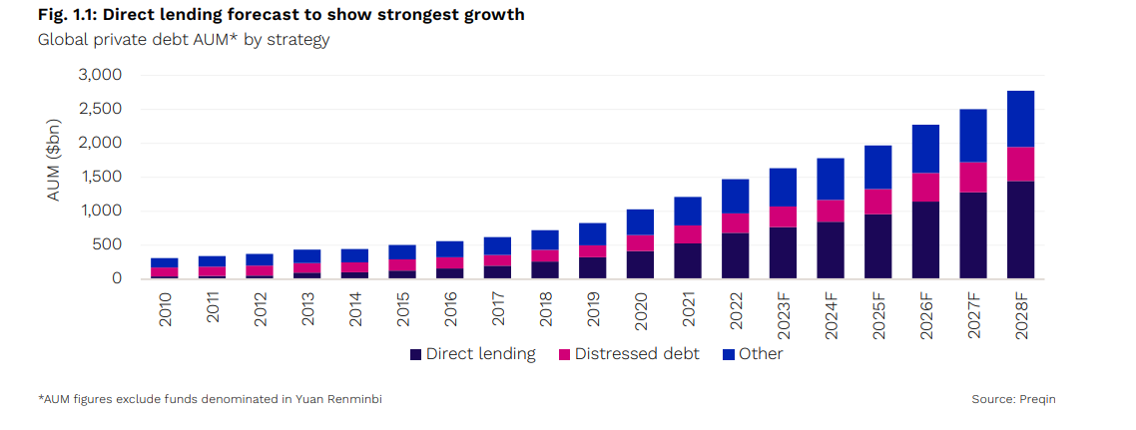

Private credit is a current financial topic of interest among individuals, advisors and even banking institutions – look no further than today’s headlines or this month’s industry event to find vibrant conversation on ideal strategies and expectations. Preqin estimates that $1.5 trillion has been invested in all forms of private credit as of 2023, and the trajectory is swiftly rising.1

Source: Preqin Private Debt Report.

Private credit investors have a choice between large-scale funds and smaller, specialty funds that focus on niche situations. Here, we examine the attributes of both to support data-driven decision-making amidst the private credit frenzy.

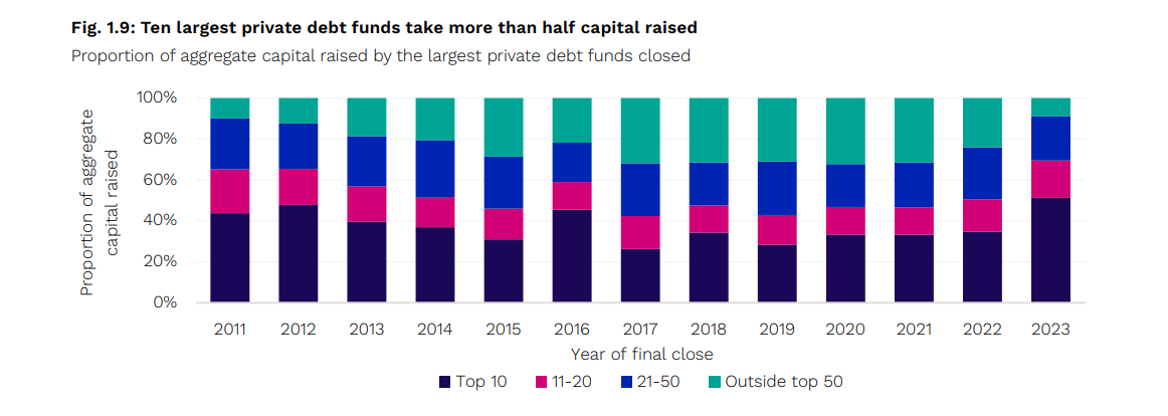

Sponsored vs. Non Sponsored

Within private credit, direct lending has steadily become the dominant strategy, having captured approximately 47 percent of all private credit assets raised in 20232. Within direct lending, there is a large division between sponsored versus non-sponsored loans. Sponsored loans are borrowings made by companies that are backed by private equity firms. Sponsored loans compose approximately 70 percent of the U.S. direct lending market according to Debtwire/CreditFlux estimates, and made up 85 percent of the European market in Q3 2022 according to Deloitte’s Alternative Lender Deal Tracker. Large firms tend to dominate as measured by assets under management. Preqin reported that in Q2 2023, $71.2 billion was raised in private credit, and 38 percent of that raised capital was comprised of two transactions, a $17 billion fund targeting junior credit by HPS Investment Partners (a spin-out from JP Morgan) and a $10 billion fund focused on senior secured lending. There is ample, exciting activity being driven by smaller, well-crafted transactions.

Source: Preqin Private Debt Report.

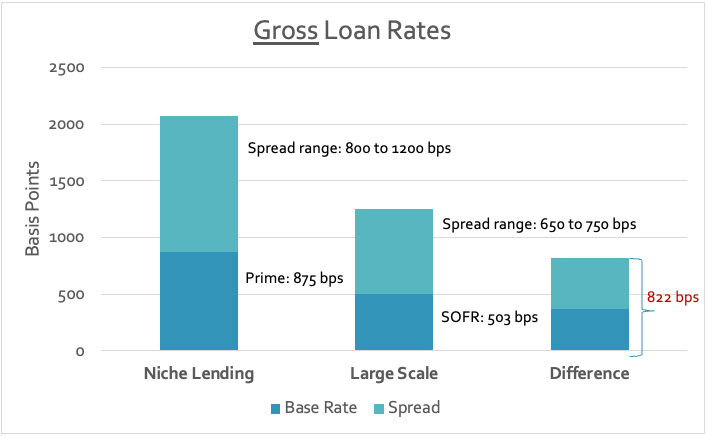

Pricing

Despite the dominance of large firms in direct lending, there is competition for lending to prime large companies and even upper middle-market companies. Small to middle market companies, and particularly ones that are unique, complex or have time-sensitive circumstances, have a more difficult time finding lenders. This is reflected in the general pricing of loans.

Source: Chicago Atlantic, Apollo Academy : The Case for Credit, December 2022

Note: Lending rates are estimated and do not represent past performance.

Specialty, niche market lenders have the potential to charge as much as 800 basis points more for their loans due to supply and demand, company and industry circumstances and risk premium factors.

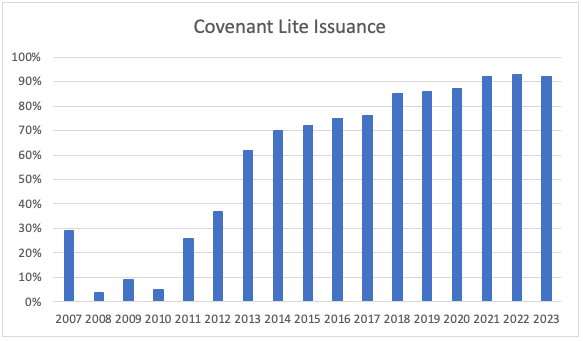

Covenants

In competitive markets, it is increasingly common to see more relaxed covenants as incentives for borrowers to choose one lender over another.

Source: Nomura Private Credit, Pitchbook LCD, Apollo

However, less competitive niche markets are more lender-friendly, allowing lenders to maintain tighter covenants. These include minimum cash requirements, deposit account control agreements, fixed charge coverage ratios and other features.

Structuring

In the large-scale lender market, there are often multiple lenders participating in one deal, while specialty loans allow for one lender to write and control the loan. For the borrower, this presents a potential advantage as they may be able to work with the lender to create a structure that meets their specific needs. For the lender, protective terms can be implemented such as all asset liens, mortgage deeds on real property, attachments to IP or licenses and even personal guarantees.

Profitability

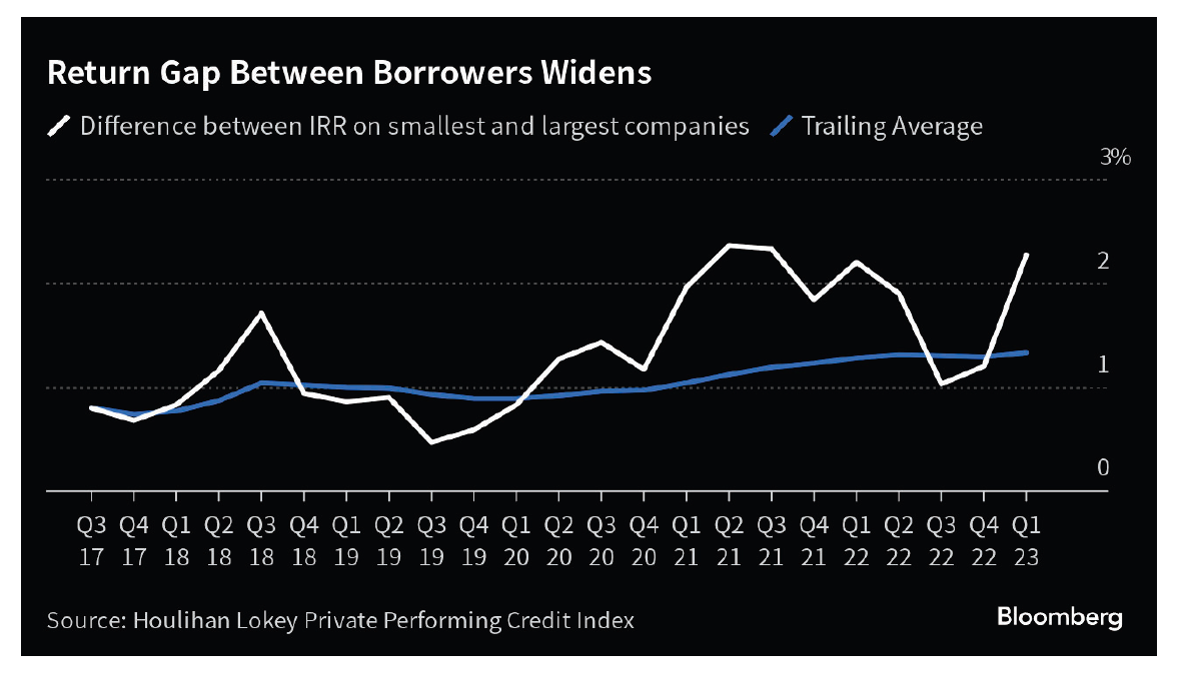

Opportunities in more niche, small to middle markets can offer higher gross lending rates, as noted above, and potentially higher returns for investors. The chart below from Bloomberg illustrates that, historically, lending to the smaller size segment has been beneficial producing a return premium.

In summary, the private credit asset class has strong potential for attractive returns, particularly for investors looking for diversification and opportunity apart from public market fixed income. Within direct lending, large-scale lenders can offer returns potentially above public market options. Specialty firms that focus on industries and companies where demand for credit exceeds supply enables those lenders to receive higher loan rates and more attractive loan structures. As such, specialty lenders in niche markets have the potential to earn excess returns over both public market options and large-scale lenders.

1, 2 Preqin Private Debt Report

IMPORTANT INFORMATION

This material is provided for the information purposes only and neither it nor its contents may be copied, reproduced, republished, posted, transmitted, distributed, disseminated, or disclosed, in whole or in part to any other person in any way without the prior consent of Chicago Atlantic Advisers, LLC (“Chicago Atlantic”). By accepting the materials, you agree and acknowledge that your compliance is a material inducement to our providing these materials to you.

This material does not constitute nor should be construed as an offer to sell or a solicitation of an offer to buy any securities, investments, or products in any jurisdiction, nor do they contain or constitute investment advice or recommendations, or the offer to provide any investment advice or service. Chicago Atlantic and its affiliates make no representation or warranty, either express or implied as to the accuracy, completeness, or reliability of the information or opinions contained in this presentation.

Certain information contained herein is based on or derived from information provided by independent third-party sources. Chicago Atlantic has not independently verified any of such information.

All investment strategies involve risks, there can be no assurance that the investment objectives of any particular strategy will be met in any particular circumstances. The contents of this document are not legal, tax, accounting, or investment advice or a recommendation. You should consult your own counsel, and tax and financial advisors as to legal and related matters concerning any information described herein. Neither the U.S. Securities and Exchange Commission nor any U.S. state or non-U.S. securities commission has reviewed or passed upon the accuracy or adequacy of these materials. Any representation to the contrary is unlawful.