March 11, 2024

Covenant-Lite: A Historical Cautionary Tale

Remember 2008? I do, but not just because Harrison Ford made the ultimate return as Indiana Jones or Heath Ledger left us with the Joker. I remember the country’s worst financial crash since the Great Depression, delivered at the hands of covenant-lite loans.

How Covenant-Lite Loans Instigated Economic Collapse

During this time, confidence in the banking sector plummeted as defaults in sub-prime mortgages piled up, arguably set off by poorly structured residential mortgages and related securities containing them. These mortgages had few, if any, covenantal provisions, otherwise known as covenant-lite loans.

Compounding the problem, the practice of structuring covenant-lite loans spread into other segments of the financial system. A headline and first paragraph in The Wall Street Journal on March 18, 2009 called attention to this practice and read as follows:

Covenant-Lite Loans Face Heavy Hits Amid Financial Crisis

Covenant-lite loans, a hallmark of the buyout boom, were supposed to give private-equity owned companies the flexibility to ride out a recession. The ride is now getting very bumpy.

This report was revealing at the time and is perhaps prophetic as we review today’s credit markets. Here is a recent headline from Bloomberg, October 26, 2023:

Private Credit Lenders Giving Up Protections to Win Bigger Deals

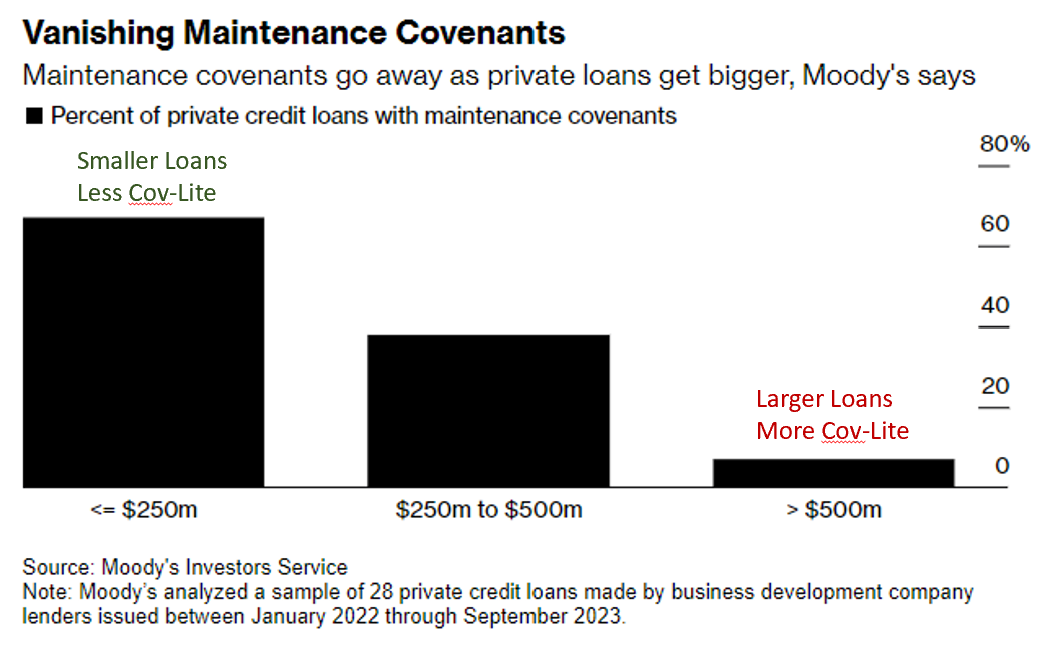

- Maintenance covenants almost gone in large loans, Moody’s says

- Competition with banks for business spurring weaker safeguards

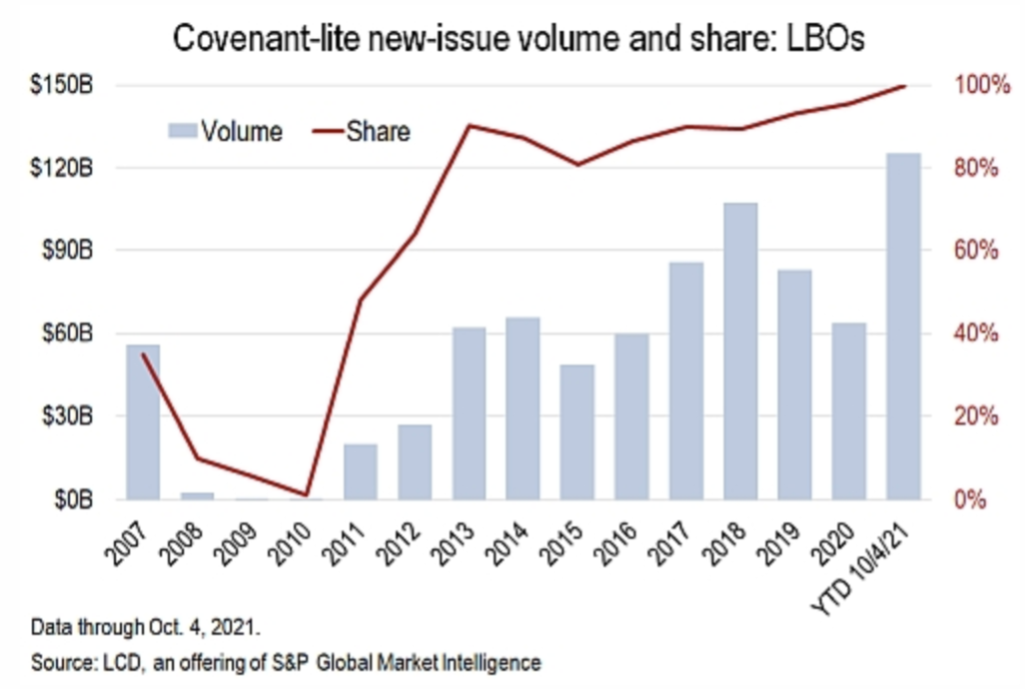

The article states that in larger loans the percentage of covenant-lite packages can reach as high as 93 percent. Below, S&P Global shows covenant-lite practices are currently extending across segments of the loan market. For example, for leveraged buyout financings (LBO), the percentage of covenant-lite loans is higher than 95 percent, significantly surpassing the percentage present during the Great Financial Crisis:

Why the Resurgence?

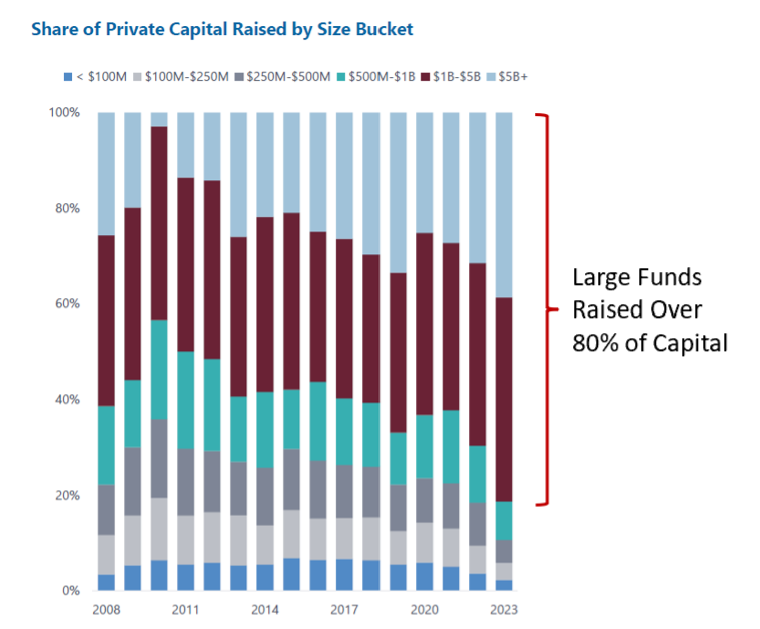

Competition is heating up for lenders seeking large, sponsored loans. This is a consequence of the tremendous volume of capital that has flowed into the private credit space. Pitchbook reported that private credit firms raised $122 billion in the first seven months of 2023, an increase of approximately 10 percent over the same period in 2022. Interestingly, the large funds were responsible for over 80 percent of the capital raised, leading to significant concentration of capital in these few funds.

To deploy such massive amounts of capital, lenders are enticing borrowers with covenant-lite loan packages. This tips the balance of risk and reward towards the borrowers’ favor, as lenders are willing to allow more freedom and flexibility for borrowers and consequently take on more risk associated with these loans.

Why It Matters

Covenants are a key part of any loan. They contain specific guidelines for specific metrics of liquidity and debt burden of the borrower. Should these guidelines be violated, remedies must be made by the borrower or the loan will go into default. Typical covenants include:

- Interest Coverage Ratio

- Fixed Charge Coverage Ratio

- Minimum Cash Coverage

- Permitted Debt

- Debt: EBITDA Ratio

- Debt: Equity Ratio

Other criteria may be included such as reporting requirements and frequency of reporting, deposit account control agreements, dividend payouts, distributions and sale of assets. These covenants allow for close monitoring of the borrower’s business, creating an early warning system and risk management tool for the lender. By keeping close tabs, the lender may identify when risk is increasing and step in before guidelines are violated in order to help avoid defaults and subsequent workouts. This is beneficial for both the borrower and the lender.

Covenant-lite loans have minimal covenants and may feature:

- Covenants that are not maintenance based (i.e., not tested periodically)

- Covenants that only apply to revolving credit lines and not to term loans

- Covenants that allow for modifications (i.e. add-backs) to key metrics such as EBITDA

Without these key features in the loan package, the lender has much less insight into the condition of the borrower, no actionable triggers and may be hindered in the recovery of assets in the event of default.

What Can Investors Do?

- Take note that covenant-lite loans are less prevalent with smaller loans. There is less competition for smaller loans. Some lenders – Chicago Atlantic included – intentionally pursue segments of the loan market where smaller loans can be prioritized.

- Explore niche business segments where the demand for capital exceeds the supply. This most often occurs in cases where structural or intrinsic aspects of a borrower prevent them from accessing traditional financing (i.e., esoteric industries). This allows lenders to negotiate strong covenant packages and mitigate the risk of lending. It can also allow lenders to obtain premium rates.

It’s said that history doesn’t always repeat, but it does rhyme. The trend towards covenant-lite lending appears to be rhyming rather strongly relative to the practices leading up to the Great Financial Crisis of 2008.

Investors should be cautious as they look at various segments of the private credit sector. The amount of capital flowing into private credit shows no signs of abating, and it’s important that investors understand the impact that is having on large lender strategies. They should understand the implications of covenant-lite lending and compare its risks against those of other segments that are less prone to covenant-lite practices.

The niche business segment of private credit has largely avoided covenant-lite practices and offers a potential alternative for investors who have previously been focused on firms lending in the large, sponsored loan market.

Additional Citations

Wall Street Prep, Covenant-Lite Loans, June 2023.

IMPORTANT INFORMATION

This material is provided for the information purposes only and neither it nor its contents may be copied, reproduced, republished, posted, transmitted, distributed, disseminated, or disclosed, in whole or in part to any other person in any way without the prior consent of Chicago Atlantic Advisers, LLC (“Chicago Atlantic”). By accepting the materials, you agree and acknowledge that your compliance is a material inducement to our providing these materials to you.

This material does not constitute nor should be construed as an offer to sell or a solicitation of an offer to buy any securities, investments, or products in any jurisdiction, nor do they contain or constitute investment advice or recommendations, or the offer to provide any investment advice or service. Chicago Atlantic and its affiliates make no representation or warranty, either express or implied as to the accuracy, completeness, or reliability of the information or opinions contained in this presentation.

Certain information contained herein is based on or derived from information provided by independent third-party sources. Chicago Atlantic has not independently verified any of such information.

All investment strategies involve risks, there can be no assurance that the investment objectives of any particular strategy will be met in any particular circumstances. The contents of this document are not legal, tax, accounting, or investment advice or a recommendation. You should consult your own counsel, and tax and financial advisors as to legal and related matters concerning any information described herein. Neither the U.S. Securities and Exchange Commission nor any U.S. state or non-U.S. securities commission has reviewed or passed upon the accuracy or adequacy of these materials. Any representation to the contrary is unlawful.